Update on lender interest rates All lenders have increased their interest rates in line with the 0.75% RBA cash rate increase, but I expect some lenders to target specific areas of lending, e.g., low Loan to Value Ratios, or loan amounts, or both; or ‘professional’ borrowers that have stable employment.

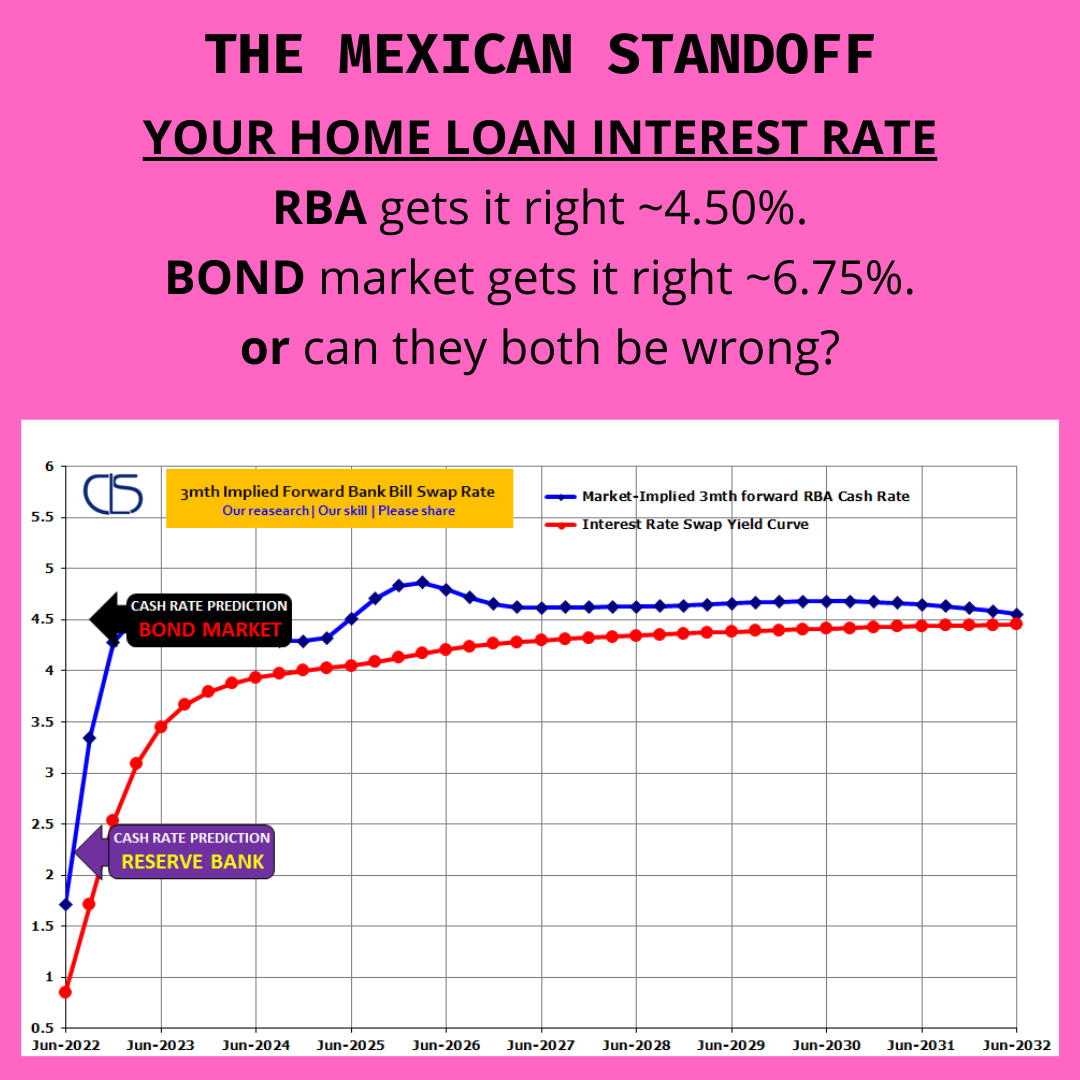

Bond market months ahead of the RBA The Reserve Bank (RBA) is not the only one that sets interest rates, the bond market does too, and is winning the interest rate war.

RBA predicts cash rate The RBA, on 14 June 2022 (ABC 7.30report), predicted the cash rate will be at 2.25% soon. If this were to occur, your home loan interest rate would be about 4.50%, double what it was before 2 May 2022.

RBA predicts peak inflation The RBA also predicted that inflation would hit 7% (from 5.1% for the March 2022 quarter) by Christmas and that it wouldn’t begin to fall until March 2023. This will give a real interest rate of negative 4.75% (2.25% cash rate less 7% inflation), which will create more inflation, but understandably the RBA may be worried about the debt burden of households (illegal to print money) and governments (that can print money via the central bank’s printing press).

BOND market begs to differ The Interest Rate Swap (IRS) market (and the bond market) beg to differ and if correct with its 4.50% cash rate prediction (and RBA is wrong again), your home loan interest rate would be about 6.75% or three times what it was before 2 May 2022.

Mortgage Stress Just one of many examples, take a borrower that bought a median Sydney house price in March 2021 ($1,290,000) and got a loan ($1,032,000) at a competitive interest rate (2.35%) and paid the minimum monthly repayment, then their interest rate would be 3.10% today, the monthly repayments would have increased by approximately $394 or 10%.

If the RBA’s prediction happens, then this borrower’s interest rate will be 4.50%, the monthly repayments would increase by approximately $1,184 or 30%.

At the time of the loan application in March 2021, the annual inflation rate was 1.1%. Today, the RBA expects the government reported inflation rate to peak at 7% by December 2022 – but let’s get real, the cost-of-living inflation is much higher. Input all these numbers in an affordability calculator, and the likelihood this borrower experiencing mortgage stress is high.

If the Interest Rate Swap market’s prediction happens, then it will be catastrophic for the consumer and the economy.

Our view remain unchange The 24 March 2022 view remains unchanged – RBA to increase the cash rate to about 1.75%, and then pause for 6-12 months to see how the consumer and the economy survive being hit with cost of living inflation and interest rate rises.

Until proven wrong I am opened minded to a higher cash rate than 1.75% but I find it hard to argue in favour when the 10-year government bond yield (USA and Australia) are both (this is not advice) showing extreme signs of price exhaustion and divergence (technical analysis view from on 4 June 2022 remains intact), and will likely move sideways before a substantial move lower.