TODAY’S HOME LOAN INTEREST RATES

A competitive Owner-Occupied Home Loan variable interest rate today would be about 2.15% compared to 2.45% in May 2021; a 2-year fixed would be about 2.80% today compared to 1.85% in May 2021; a 3-year fixed would be about 3.35% today compared to 1.90% in May 2021; and a 5-year fixed would be about 3.95% today compared to 2.00% in February 2021.

Can you visualise how lenders use interest rate promotions at different cycles to their advantage?

THE JOHNNIES COME LATELY

The Johnnies-come-lately, about a year too late, are now paddling that interest rates would rise and fixing your home loan may not be a bad idea (just do a search). Fear infects the consumer to rush to fix their home loan interest rate, irrespective or not if there is any logic in doing so at today’s prices. Always remember, the market prices what will happen next at least 6 to 9 months in advance.

INFLATION GONE WILD

Central Banks, particularly the USA Federal Reserve (FED) have a problem with their ‘transitory’ inflation gone wild, exactly (annual) 8% for the month of February 2022 (see below chart). The FED is faced with about 8% negative real interest rates (the difference between interest rates and inflation), whilst our own Reserve Bank (RBA) is faced with about 4%.

HELP/HECS Fees

HELP/HECS Fees will be indexed to the inflation rate on 1 June 2022, and it will be a shocker to those that have this debt. There were 2.9m people with an outstanding HELP debt of ~AUD$69billion as of 30 June 2021. And then their next hurdle is home ownership affordability.

Inflation for the March 2022 quarter will be released on 27 April 2022, and the annual inflation rate will most likely be between 4-5%.

THE INFLATION SLAYERS

The market is punishing the central banks for not acting on inflation sooner by increasing first, long term interest rates and then short term interest rates and thereafter both, flattening the yield curve and daring to invert it (short term interest rates higher than long term interest rates), which is an early warning sign of recession ahead.

Interest rates will need to rise but unless the central banks shock with much higher increases in interest rates than what the markets expect, and more often, they will not even be punching water. On Wednesday 16 March 2022, the FED paddled a 0.25% rise in interest rates to slay inflation, with a tough talk promise of more to come.

LENDERS WOULD LOVE YOU EITHER WAY BECAUSE THEY CANNOT LOSE

Lenders would love you to fix your home loan at current fixed interest rates and they would pay you handsomely (cashbacks) to become their customer. Recall that wholesale interest rates only rose from 0.06% on 5 November 2020 to 2.50% today.

Lenders would love you even more if you choose to stay variable because they know that once the Reserve Bank increases interest rates, they will hit you with an increase in your variable rate home loan.

COMMON SENSE APPROACH

We first alerted the need to consider fixing your home loan interest rate on 15 December 2020, followed by on 28 February 2021 and again on 18 October 2021.

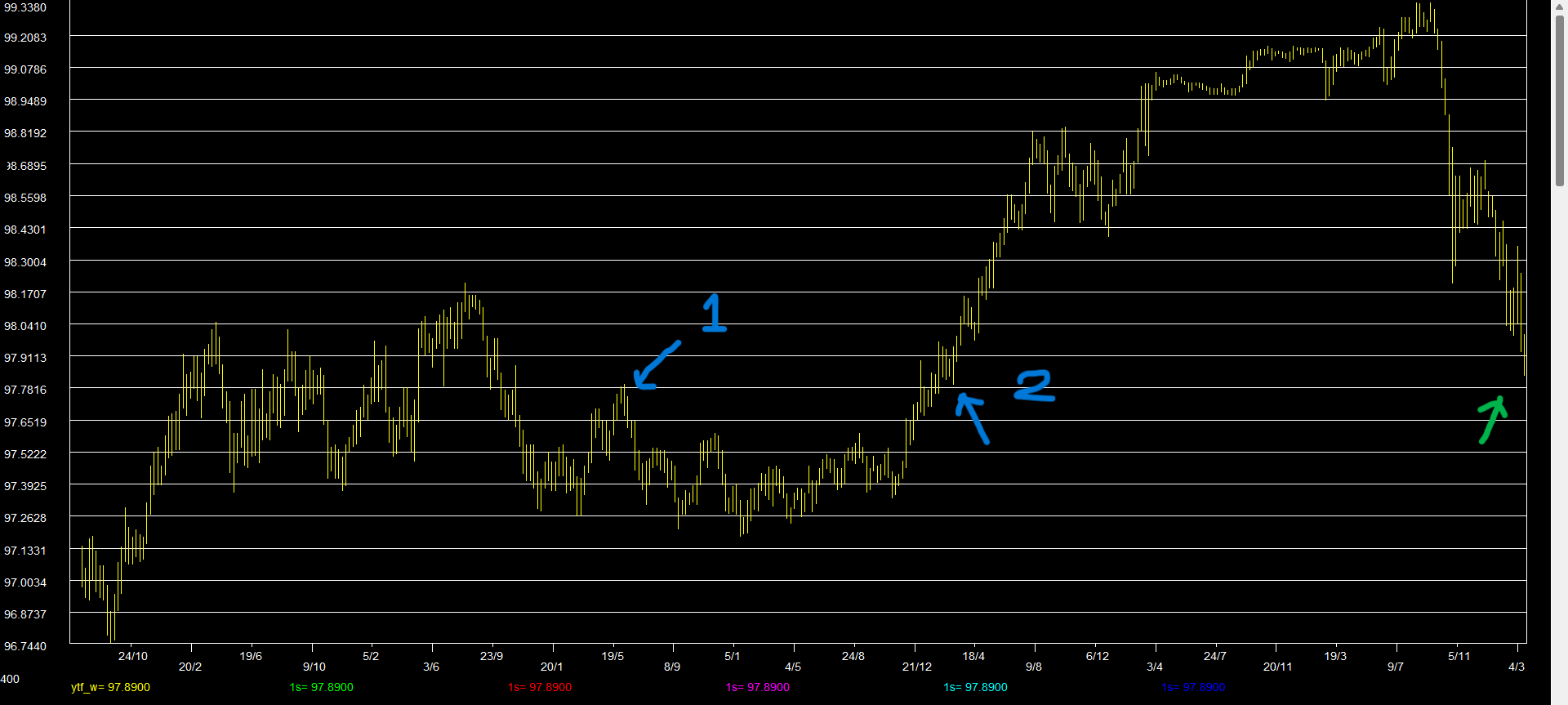

Before you decide and follow the advice of the Johnnies-come-lately to fix right now, consider this research note we posted on 15 November 2021. We have calculated that the Interest Rate Swap market was pricing in a 2.25% cash rate by November 2023 from September 2028 on 14 September 2021. Today, the same cash rate is expected by December 2022 (green arrow in below chart).

Now ask yourself if the Reserve Bank would increase interest rates by 2.15% to 2.25% by December 2022. Even if it did, your home loan variable interest rate would be about 4.40% compared to the current 5-year fixed rate of about 3.95% and 3-year fixed rate of about 3.35%, or higher depending on the lender.

Next consider this argument. Those with commercial loans that are priced against the 3-month Bank Bill Swap Rate, about 0.10% recently, would have to pay about 2.25% more, a 2,150% increase in their borrowing costs plus of course the fixed margin (line fee) the lender charges them.

A consumer, with a home loan of about 2.15% today would have to pay about 4.40% or 105% more in their borrowing costs.

It will be a catastrophic shock to consumer confidence and the Reserve Bank will highly likely pause at or about the first 1% increase in interest rates and assess the impact it had.

On 17 December 2019 we have modelled that a 1% increase in interest rates across the yield curve (from the then overnight cash rate 0.75% to 30 years interest rate swaps) will lead to a 12% drop in house prices in order to maintain the same net present value of net income (rent less outgoings). It will be more than 12% with today’s interest rates been much lower.

Last but not least each month that variable rate remains below the fixed rates, you are better off by the difference, converted to a monthly equivalent.

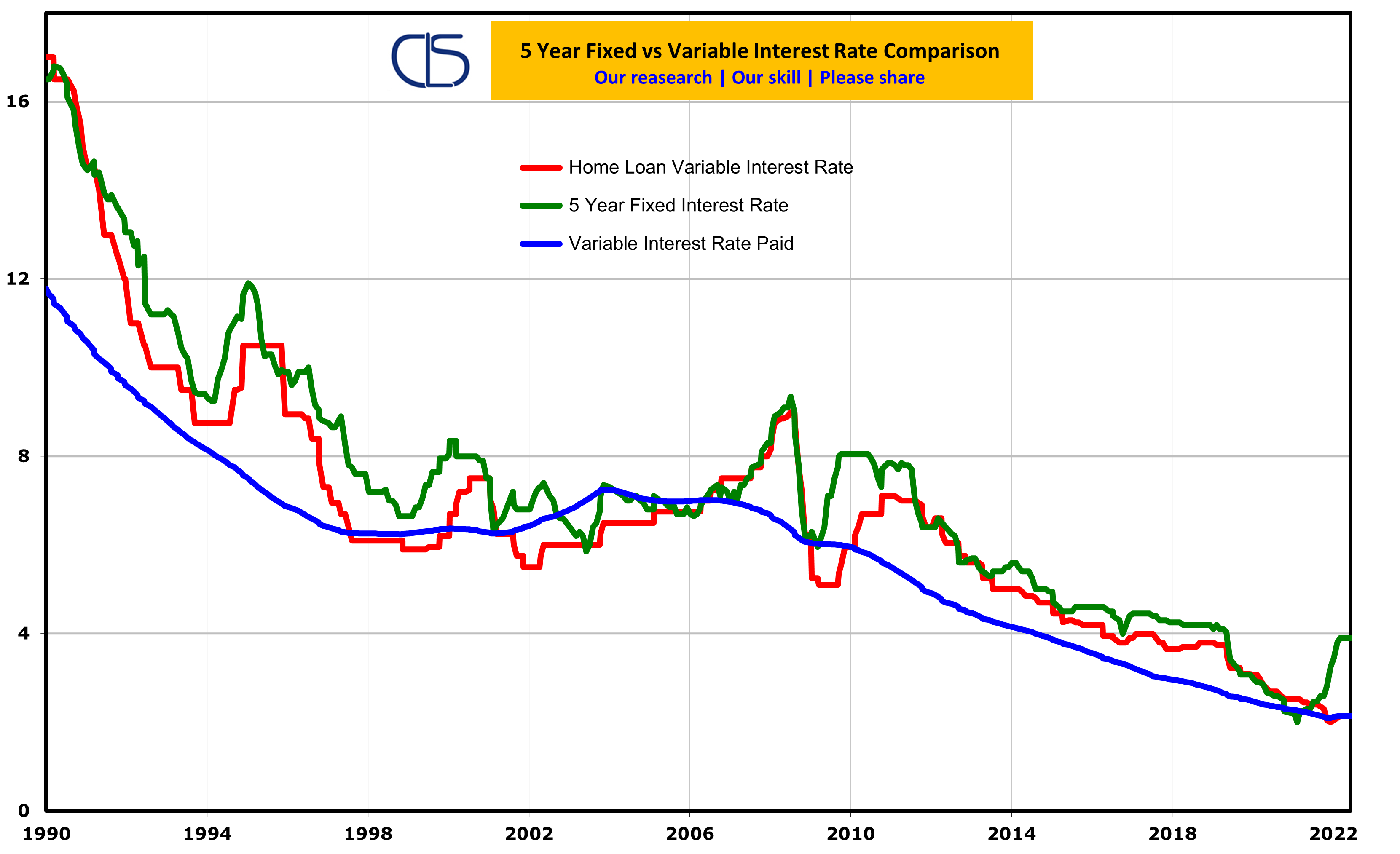

5-YEAR FIXED VERSUS VARIABLE COMPARISON

The best time to have fixed would have been between December 2020 and February 2021. But at that time, the Johnnies-come-lately were paddling further interest rates cuts.

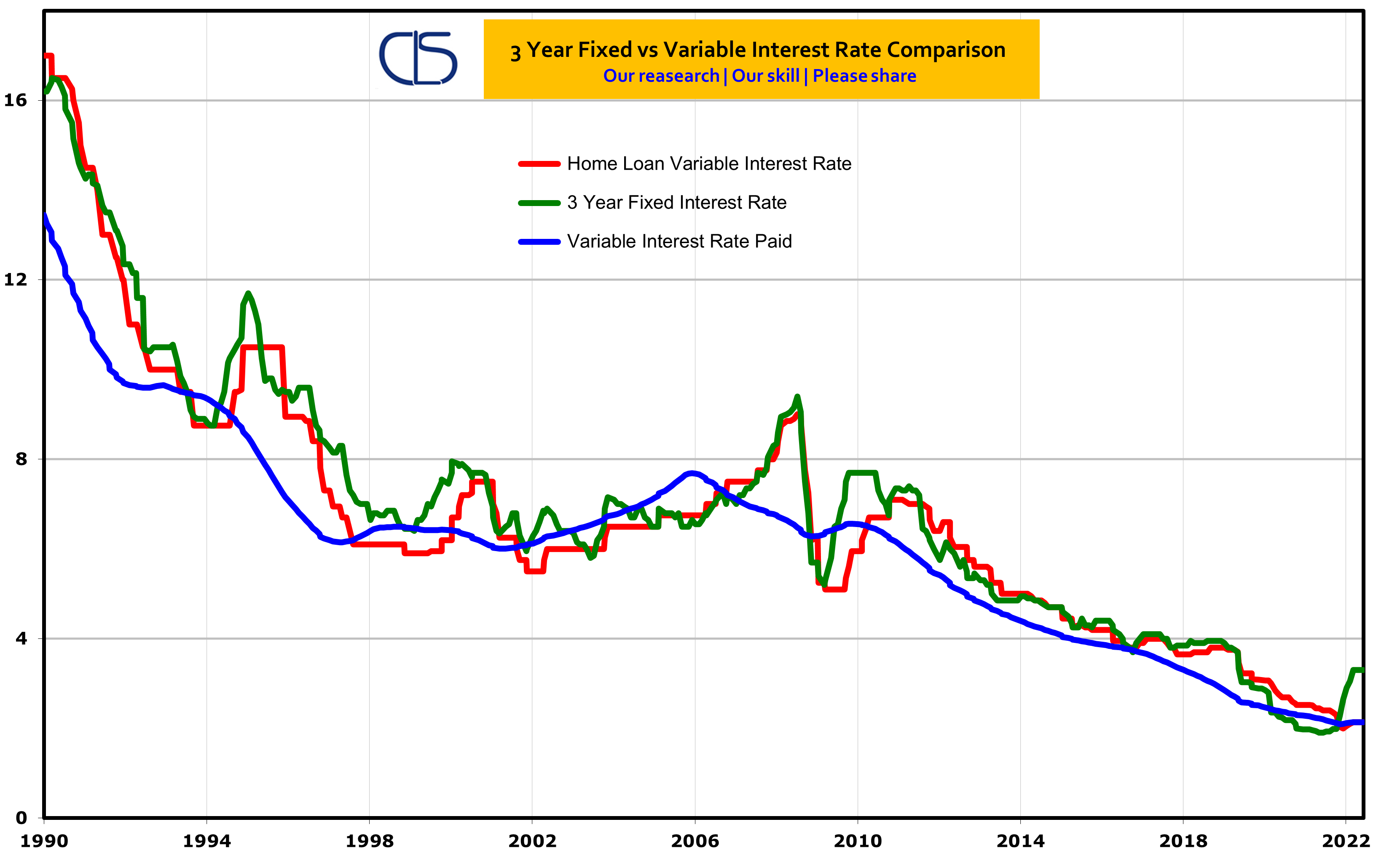

3-YEAR FIXED VERSUS VARIABLE COMPARISON

The market, in this case lenders, almost always gifts the opportunity for one more time to fix and this occurred as recently as October 2021, to fix for a term of 3-years at 1.99% or higher depending on the lender. It did not last long.

WHAT WE THINK WILL MOST LIKELY HAPPEN WITH INTEREST RATES

Our very early-stage technical indicators show that the probability of the 3-year Interest Rate Swap rate, about 2.50% today, will move lower within the next 2 to 6 months are particularly good, and therefore may present better opportunities in the near future to consider fixing for 3 years at lower rates than today. As usual, when it gets there, we shall reassess the opportunity.

The below chart (on the next page) is the 3-year Commonwealth Government Bond Futures. The blue arrow marked 2 is the breakout point from the previous recent high marked 1, that lead to the huge rally to the all-time highs. The futures have since then retraced to the green arrow which is about the same level as the breakout point.

We expect a bounce from here which will lead to lower interest rates soon and thereafter lower home loan fixed rates.

And this may result in better opportunities to consider fixing your home loan interest rate.

THIS IS NOT ADVICE. WHAT I TRACK DAILY (among other) FOR MEDIUM TO LONG TERM TRENDS IN INTEREST RATES

The USD Index, the DXY, because my technical indicators show that the DXY, if not already peaked at 99.42 on 7 March 2022, may peak in April 2022 or very soon thereafter, with a monthly price exhaustion sell signal of 85% probability occurring in April 2022.

The US Dollar was universally considered the safe haven currency in times of turmoil and uncertainty, with the main beneficiary been the US 10-year treasury note and the US stock market.

When the US stock market peaked on 4 January 2022 and fell between 14-22% depending on the index (Dow Jones, SP500, Nasdaq), the DXY bottomed on 6 January 2022 at 89.20, and increased thereafter as the flight to quality safe heavens trades were sought.

The weaponizing of the US dollar post 24 February 2022 may have changed that for ever.

The US 10-Year Treasury Note because the FED has become the lender and buyer of last resort of US Government Debt with an USD$9trillion balance sheet.

The Dow Jones to Gold Ratio because it’s one of the most powerful charts that exists in the financial markets.

Whether you agree or not, Gold has been the ultimate hedge against a collapse of the stock market and financial system, whether that collapse is big or small, viz 1929 where Gold outperformed the stock market by 1,000%; 1970s where Gold outperformed the stock market by 2,700%; between 1999 and 2011 where Gold outperformed the stock market by 650%; and most likely from 3rd quarter 2022 or first quarter 2023 onwards (where I expect the US stock market indices (Dow Jones, SP500, Nasdaq) to make an attempt to recover the 6 January 2022 highs and perhaps exceed them before failing and collapsing between 40-70%.