Your pay is or will be docked to pay for your HECS/HELP fees.

Your taxes will then be used to gift property investors with billions of dollars in annual negative gearing tax breaks.

You are burdened with the unabated super nova public debt pile, compliments of successive governments that keep on robbing from the future to fund the avarice of yesterday and today.

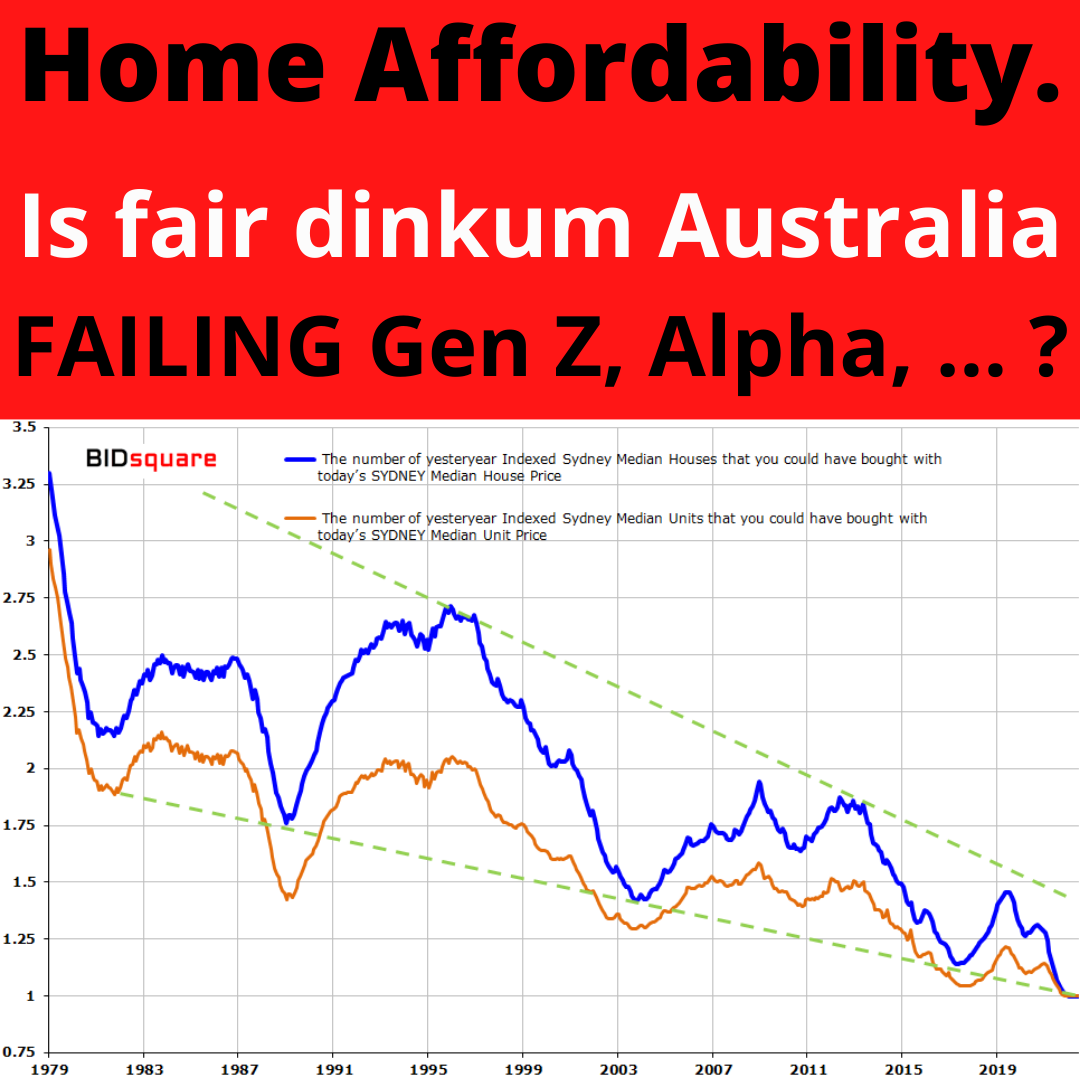

You are asked to pay, in indexed affordability prices (refer chart), approximately 3.3x more than what Gen Boomers paid for their homes in late 1970s; 2.7x more than what Gen X paid for their homes in 1990s; 1.8x more than what the lucky early born Gen Y paid for their homes in early 2010s; 1.4x more than for those that bought in the greatest transfer of wealth from the poor to the mega rich because of the biggest orgy of money printing the world has ever seen, just less than 2 years ago in 2020.

You will be given, if you qualify, a once off pittance First Home Buyers’ grant to … appease you. Don’t forget that property investors are always qualified, and will always be subsidised every year, and not just a once off.

Negative gearing must be restructured.

How hard would it be for any government to pass legislation to have tax losses on each and every investment property quarantined to that property until that property makes a profit, and then and only then the losses attributed to that property can be offset against that property’s profits.

It can be done. Just refer the naysayers to the Tax Office. The Tax Office insist that property investors lodge accurate property investment income and expenses for each property they own, with their tax returns. Get it!

From a social class perspective, if you were born with a silver spoon or will marry a rich partner, you may well be fine. If you are not in this privileged social class, then do not forget that there will be someone else that is far worse off than you are.

In the meantime, do not despair. There is hope, even if it is at fearful odds. See that fallen wedge dotted in green on the chart. That is a falling wedge, and in technical analysis falling wedges break to the upside. This means that indexed affordability house prices in the future will get much, much cheaper than today. This could be achieved by nominal house prices falling, higher inflation, higher interest rates, higher property expenses, lower rents, or any combination of these.

Don’t get mad, get even. Start a petition, lobby politicians, prey on previous generations’ greed and avarice, to abolish negative gearing.